SHERWIN WILLIAMS (SHW)·Q4 2025 Earnings Summary

Sherwin-Williams Beats Q4 Estimates as Margin Expansion Continues Despite Soft Housing Market

January 29, 2026 · by Fintool AI Agent

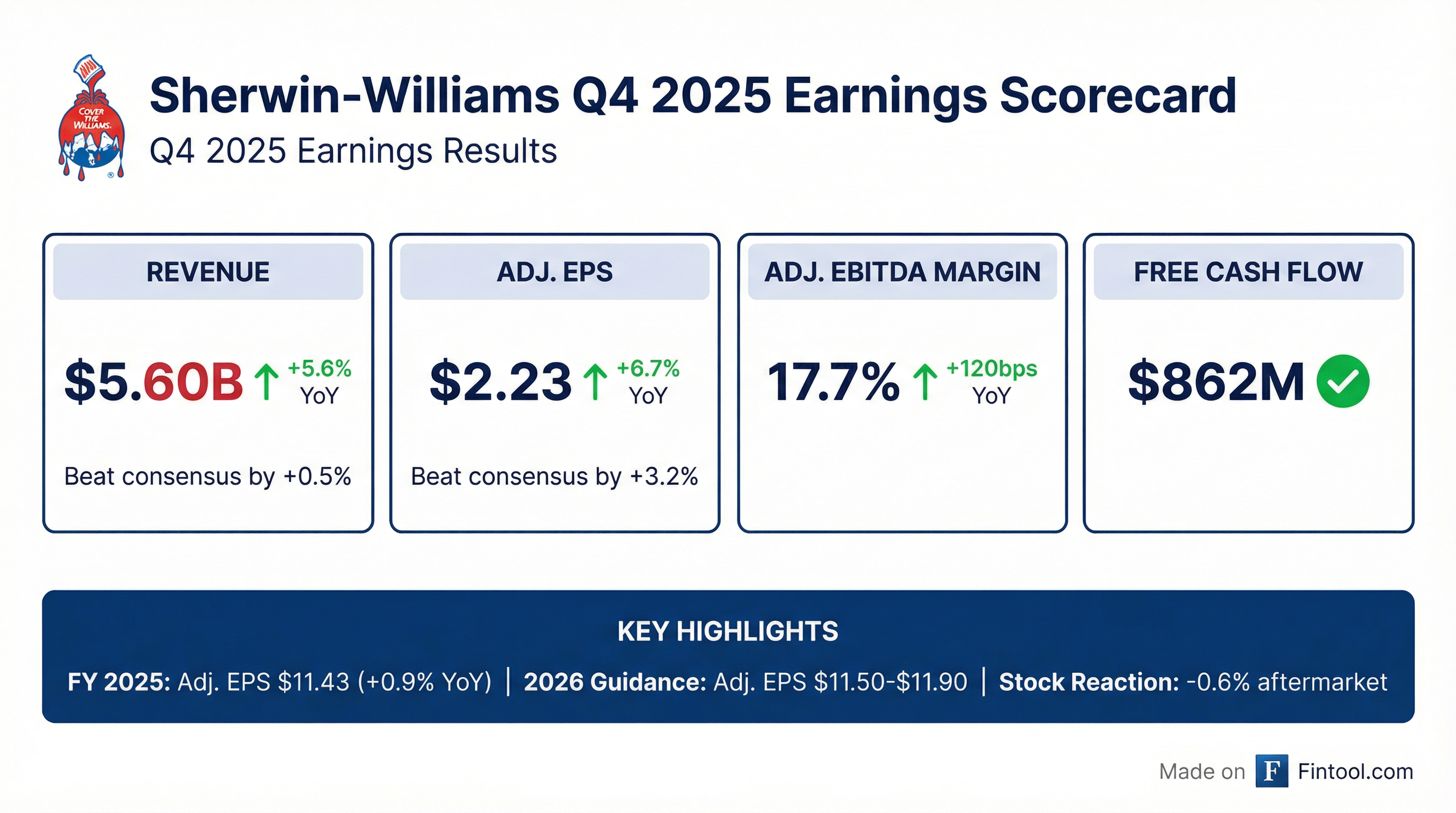

Sherwin-Williams delivered a solid close to fiscal 2025, beating both revenue and EPS estimates despite persistent weakness in the housing market. The paint giant reported Q4 adjusted EPS of $2.23, topping the $2.16 consensus by 3.2%, while revenue of $5.60 billion exceeded expectations by 0.5%. The stock traded down ~0.6% in aftermarket trading as investors digested cautious 2026 guidance that reflects continued macro uncertainty.

Did Sherwin-Williams Beat Earnings?

Yes — both revenue and EPS exceeded consensus estimates:

The beat was driven by better-than-expected execution across all three segments, with consolidated sales increasing at the "high end of guided range" per management. Price/mix contributed low-single-digit growth, acquisitions (primarily Suvinil) added low-single-digits, and favorable FX provided a tailwind — partially offset by low-single-digit volume declines.

Full Year 2025 Results:

How Did Each Segment Perform?

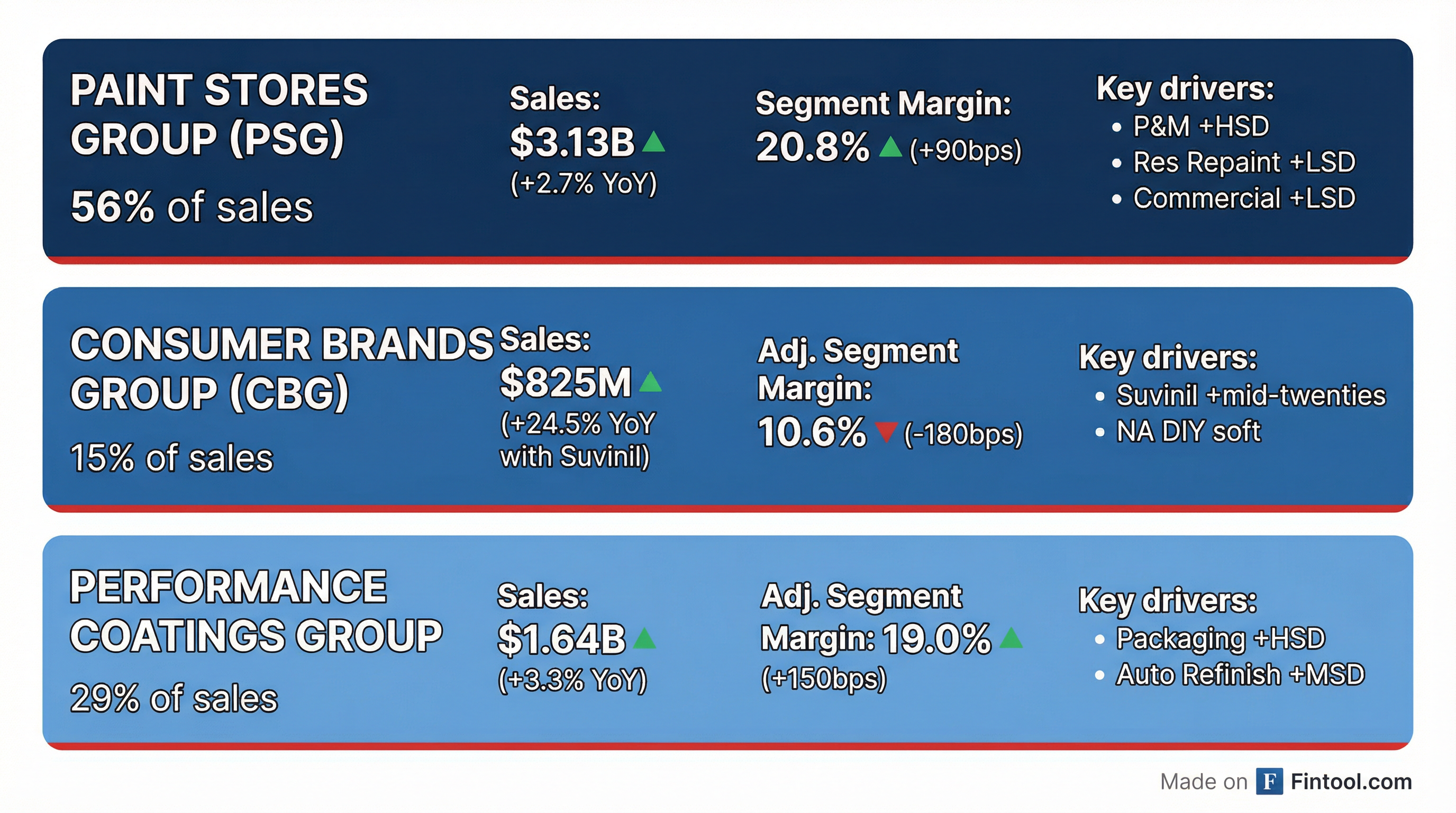

Paint Stores Group (PSG) — The Core Engine

PSG, representing 56% of sales, delivered 2.7% revenue growth with segment margin expanding 90 basis points to 20.8%.

Key segment drivers:

- Protective & Marine: +HSD growth — fifth consecutive quarter of strong performance driven by energy, water infrastructure, and high-performance flooring

- Residential Repaint: +LSD at high end vs. tough +HSD comparison; soft existing home sales continue to pressure the repair & remodel market

- Commercial: +LSD driven by new account and share-of-wallet growth

- New Residential: -LSD; soft housing starts and completions partially offset by new account growth

Consumer Brands Group (CBG) — Suvinil Outperformance

CBG reported 24.5% revenue growth, driven almost entirely by the Suvinil acquisition (+mid-twenties contribution). Adjusted segment margin declined 180 bps to 10.6% as the company absorbed incremental SG&A from Suvinil and faced continued soft DIY demand in North America.

Regional performance:

- North America: -LSD; DIY consumer remains under pressure

- Latin America (Suvinil): +mid-twenties

- Europe: +LSD driven by share gains

Performance Coatings Group (PCG) — Industrial Stability

PCG grew 3.3% with adjusted segment margin expanding 150 bps to 19.0%.

Division highlights:

- Packaging: +HSD vs. +DD comparison — continued new account growth

- Auto Refinish: +MSD driven by new account wins

- General Industrial/Industrial Wood: +LSD; new account wins offset soft core markets

- Coil: -LSD given tariff-related headwinds

What Did Management Guide for 2026?

Sherwin-Williams provided FY 2026 guidance that implies modest growth despite expecting the challenging demand environment to persist:

Q1 2026 Guidance:

- Consolidated sales up mid-single-digit %

- PSG: up low-single-digit %

- CBG: up low to mid-teens % (Suvinil contribution)

- PCG: up mid-single-digit %

Key guidance assumptions:

- Raw materials up low-single-digit % (inclusive of tariffs and commodity inflation)

- Mortgage rates to remain in low 6% range

- Existing home sales expected +LSD % as affordability remains challenged

- Single-family housing starts down -MSD %

- Industrial production flat with no material improvement

How Did the Stock React?

Shares traded down approximately 0.6% in after-hours trading following the report, declining from $349.60 to $343.95. The muted reaction likely reflects:

- Guidance conservatism — FY26 adjusted EPS midpoint of $11.70 implies just ~2% growth despite executing well

- Housing uncertainty — Management reiterated "softer for longer" outlook with minimal demand catalysts visible

- Already priced in — Stock had rallied ~4% over the prior week heading into the print

Recent stock performance:

- 52-week high: $379.65

- 52-week low: $308.84

- Current (after-hours): $343.95

- YTD return: ~+1%

What Changed From Last Quarter?

Positives:

- Adjusted EBITDA margin expanded 120 bps QoQ (17.7% vs 16.5% in Q4 2024)

- Free cash flow conversion improved to 90.1% in Q4 vs 59.2% for full year

- Suvinil integration tracking ahead of plan (+mid-twenties vs. guidance)

- Net debt/EBITDA improved to 2.3x, well within 2.0-2.5x target

Negatives:

- Gross margin contracted 10 bps YoY to 48.5% due to Suvinil dilution

- Volume remained negative (-LSD) despite share gains

- 2026 guidance embeds continued macro weakness through H1 and likely beyond

Balance Sheet & Capital Allocation

Sherwin-Williams maintains a strong financial position with significant liquidity:

2025 capital returns: Returned $2.4 billion to shareholders through dividends and share repurchases

Debt maturity profile: Near-term maturities are manageable — $350M due in 2026, $1.5B in 2027

What Did Analysts Ask About?

The Q&A session revealed key investor focus areas:

Price vs Volume Trade-off: CEO Heidi Petz emphasized a balanced approach: "It's not putting volume above price. It's being very balanced in our view here. In this jump ball competitive environment, there's a lot of market share up for grabs right now." Management expects low single-digit price realization on the 7% headline increase due to competitive dynamics.

401(k) Reinstatement: Management announced the 401(k) match program will be reinstated effective February 1, with retroactive contributions restored by end of Q1. Petz framed the decision: "When many companies chose widespread layoffs, we chose a different path. We chose to protect jobs, retain talent, and invest in the long-term health of the organization."

Data Center Opportunity: When asked about Protective & Marine drivers, Petz highlighted AI infrastructure: "This is where Sherwin-Williams is exceptionally well positioned because of the boom we see with AI infrastructure. As you look across that PNM division... these data centers, every surface that needs to be coated, we've got a solution."

Competitive Disruption: On the recent "mega-merger" in the industry (likely referring to AkzoNobel/PPG speculation), Petz noted: "The word disruption is the right word... there's a lot of shift across the competitive set on both architectural and industrial. What I'm most excited about is the stability of our strategy."

Product Innovation: The company is launching a zero VOC plant-based interior coating by end of Q1 2026 — described as "the best paint we've ever made" — aimed at accelerating Residential Repaint share gains.

DIY Market Context: Management noted DIY represents approximately 40% of available gallons, and "when it starts to move, you're going to want to come along for the ride, but we just need it to start moving."

Forward Catalysts to Watch

Potential upside:

- Mortgage rates declining toward 6% could unlock pent-up existing home sales demand

- Continued competitive dislocation from industry "mega-merger" creating share gain opportunities

- Suvinil synergy realization ahead of schedule — Petz "really excited about this acquisition"

- January 2026 7% PSG price increase implementation

- Zero VOC plant-based coating launch driving premium gallon mix

- Data center/AI infrastructure demand boosting Protective & Marine

Key risks:

- Tariff escalation impacting raw material costs (already embedded in LSD raw inflation guide)

- Housing starts remaining depressed longer than expected

- DIY consumer weakness persisting — 40% of available gallons

- Commercial completions timing uncertainty through 2027

Key Upcoming Events

2026 Financial Community Presentation: September 24, 2026 in Cleveland — will include tours of the new global headquarters and Global Technology Center that opened in December 2025.

48th Consecutive Dividend Increase: Board to consider 1.3% increase to $3.20/share (from $3.16) at February meeting.

The Bottom Line

Sherwin-Williams delivered a clean beat in Q4 2025, demonstrating continued execution excellence in a challenging demand environment. The company's "success by design" strategy — focused on market share gains, pricing discipline, and cost control — continues to deliver results even as housing and industrial markets remain soft.

CEO Heidi Petz set the tone: "Sherwin-Williams celebrates 160 years in 2026, and it's because of our employees and our culture that we're able to deliver sustainable results through all types of cycles."

The FY26 guide is appropriately conservative given macro uncertainty, but management has consistently underpromised and overdelivered. As Petz noted: "We're providing guidance that we believe is very realistic given this backdrop. We are also confident that if the market is better than we're currently seeing, we would expect to outperform."

With the balance sheet in solid shape, the 7% price increase rolling through PSG, 401(k) match reinstated, new product innovation launching, and competitive tailwinds from industry disruption, Sherwin-Williams remains well-positioned to outperform when the cycle eventually turns.

Data sources: Sherwin-Williams Q4 2025 Earnings Call Transcript, Earnings Presentation, S&P Global